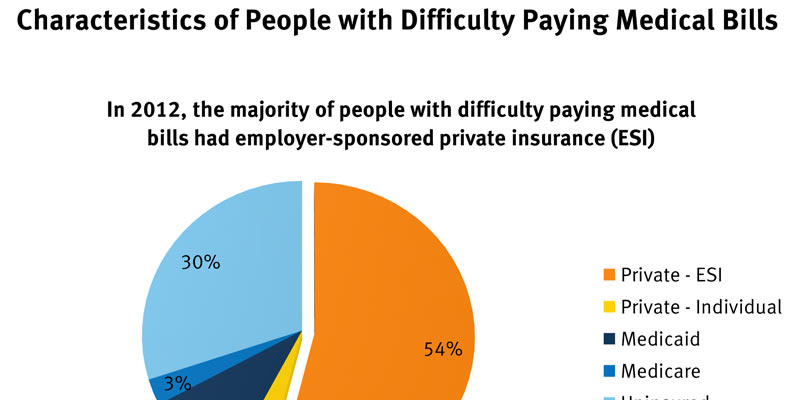

With health insurance premiums and out-of-pocket costs rising, it's no surprise that many people struggle to afford basic medical treatments. But surprisingly, even for those with solid health insurance coverage -- including employer-provided plans and Medicare/Medicaid benefits -- often managing medical costs can lead them into serious debt.

In this blog post, we'll examine some of the causes of why people with good health insurance go into medical debt so that you can better understand and assess your healthcare situation to avoid financial trouble due to medical bills.

Defining "Good" Health Insurance Coverage

When discussing people with "good" health insurance coverage, it is important to recognize that coverage varies widely. For example, employer-provided plans can have different levels of coverage based on an employee's position. At the same time, Medicare and Medicaid beneficiaries may be limited in the services and treatments they can access. All plans rarely cover all medical costs; even if they do, it may not be enough to cover all of the expenses associated with necessary treatment.

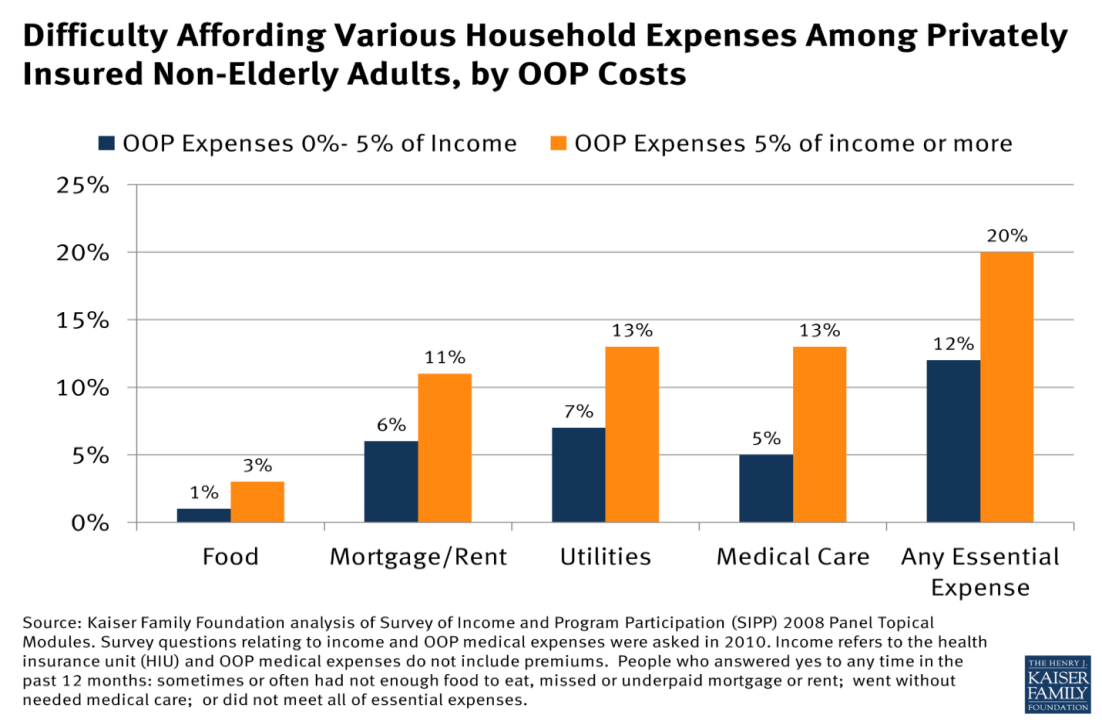

In addition to differences in coverage levels, some plans also have high deductibles that require individuals to pay for a certain amount of their medical costs before any insurance benefits are applied. High deductibles can be especially problematic for those with lower incomes who may need more resources to pay for medical costs upfront and are likely to accumulate debt.

Charging Medical Bills to Credit Cards

Another factor that contributes to why people with good health insurance go into medical debt is a lack of financial resources. For many, medical bills can be so costly that they must resort to using credit cards or taking out loans to cover the cost. This can often lead to long-term debt problems, as individuals must fully pay off their balances.

Those with good health insurance coverage may think they are protected from this financial risk. Still, the truth is that even with solid plans, it can be difficult to pay for unexpected medical costs without turning to credit cards or other forms of debt.

Skipping Checkups and Cutting Corners on Care

The last factor to consider when considering why people with good health insurance go into medical debt is the risk of avoiding preventive care and necessary treatments. While it may seem like a good solution in the short term, skipping checkups or cutting corners on treatments can often lead to more expensive medical bills down the line.

For example, a routine colonoscopy may seem costly, but it can be significantly more expensive if an individual is later diagnosed with a preventable illness or condition.

Getting a Serious Medical Diagnosis

Finally, even those with good health insurance can go into medical debt if diagnosed with a serious illness or condition. Treatment for complex and chronic conditions can often require multiple visits to specialists, prescription medications, and other treatments that may not be fully covered by insurance. This lack of coverage, combined with the high costs associated with treatment, can quickly lead individuals into medical debt if they cannot pay the bills themselves.

In addition, those with serious medical diagnoses may require additional care or services not covered by insurance, such as in-home health aides and special equipment. The costs associated with these types of expenses can be significant and add to an individual's overall medical debt.

Fortunately, options are available for individuals struggling to pay their medical bills due to a serious medical diagnosis. Many medical providers offer financial assistance or payment plans to help ease the debt burden. In addition, several programs and organizations provide aid to those with chronic illnesses or high medical costs due to treatment. Finally, it is important to note that many states have laws protecting individuals from unfair collection practices from medical debt collectors. Understanding your rights and exploring all available options can minimize the chances of going into medical debt when dealing with a serious diagnosis.

Paying Hidden Costs

One of the reasons why people with good health insurance coverage end up in medical debt is due to hidden costs. Insurance companies may only include some services and treatments under their policies, such as certain drugs or physical therapy sessions, leaving patients to cover these out-of-pocket expenses. It's important to read your policy carefully to know what is and isn't covered.

Another hidden cost to be aware of is co-payments. Many health insurance plans require patients to pay a fee or co-payment for every doctor's visit, lab test, or a prescription filled. While these fees are often relatively small, they can quickly add up if you have frequent medical bills.

Encountering Opaque Pricing

When patients go to the doctor, they are often presented with a bill that is difficult to decipher and understand. This lack of transparency in medical pricing can lead individuals with good health insurance coverage into debt if they need to account for what their policy will cover and how much they have to pay out-of-pocket.

For instance, a patient could get an itemized bill with dozens of line items and no explanation for the services or how much they would be covered. On top of that, there may be charges for procedures they should have been informed about beforehand. Patients need to know the full cost of their care before it happens to avoid getting stuck with large, unexpected bills.

To avoid medical debt, patients need to ask about the cost of care before they receive treatment. Be sure to get an estimate from your healthcare provider and check with your insurance company to confirm that the services you're receiving are covered.

Pros and Cons

Pros

- Allows you to plan and budget for medical costs

- Ensures that your insurance coverage will cover the treatments you receive

Cons

- It can be difficult to obtain estimates upfront

- Some providers and healthcare facilities may not provide itemized bills with clear pricing information

The best way to avoid medical debt is by being an informed and active consumer of healthcare. Ask questions about pricing and coverage, read your policy carefully to make sure you understand what's covered, and always get an estimate before receiving treatment. That way, you can be confident that your health insurance will cover the costs of your care and safely avoid medical debt.

FAQs

Why are medical bills so hard to understand?

Medical bills can be complicated to decipher due to the complexity of insurance policies and billing processes. Additionally, some patients may receive an itemized bill with dozens of line items but need an explanation of the services or how much they would be covered.

Why is it important to ask about the cost of care before receiving treatment?

Asking about the cost of care before receiving treatment is important because it allows patients to plan and budget for medical costs and ensure that their insurance coverage will cover the treatments they receive. That way, they can avoid getting stuck with large, unexpected bills and avoid medical debt.

What's the best way to avoid medical debt?

The best way to avoid medical debt is by being an informed and active consumer of healthcare. Ask questions about pricing and coverage, read your policy carefully to ensure you understand what's covered, and always get an estimate before receiving treatment. That way, you can be confident that your health insurance will cover the costs of your care and safely avoid medical debt.

Conclusion

Medical debt can be a serious financial burden for those with good health insurance coverage. By understanding the causes of why people get into medical debt and being an informed consumer, you'll be able to manage your healthcare costs better and avoid getting into financial trouble. Feel free to ask questions about pricing and coverage from providers before receiving treatment, and make sure to read your policy carefully to understand what's covered. With some planning, you can avoid medical debt and keep your finances in check.