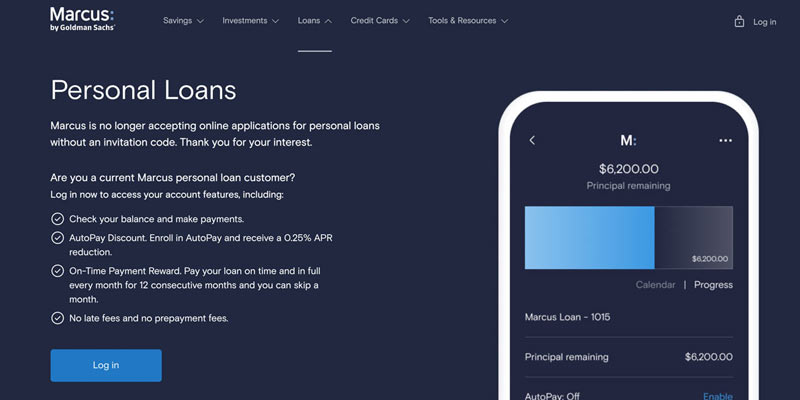

Marcus is a brand that's associated with the investment bank Goldman Sachs. They provide loans for various needs. In this review, we'll look at Marcus loans, exploring their characteristics, advantages, disadvantages, and how they stack up against other available alternatives.

Marcus offers loans ranging from $3,500 to $40,000, with interest rates (APRs) falling between 6.99% and 19.99%. Borrowers can choose a loan term of 36 to 72 months, offering them repayment flexibility. What sets Marcus loans apart is their feature of being fee free.

Unlike personal loan options, Marcus offers sign-up without any cost. Moreover, it does not levy penalties for prepayment or late payment. This absence of fees is uncommon, which adds to the appeal of Marcus loans in the loan market.

Key features of Marcus Personal Loans:

No Fees: Marcus Personal Loans has no sign-up, prepayment, or late fees. However, additional interest will be charged to your loan balance if you are late in payment.

Fixed Interest Rates: The interest rates on Marcus Personal Loans are fixed during the tenure of the loan. This means your monthly loan payments won't change.

Flexible Loan Terms: Marcus offers loan terms that range from 36 to 72 months. It allows you to choose a term according to your budget.

Loan Amounts: You can borrow anywhere from $3,500 to $40,000.

Direct Payment to Creditors: Marcus can send payments directly to your creditors if you're using the loan for debt consolidation.

On-Time Payment Reward: If you pay your loan promptly and fulfill the amount each month for 12 months, you can postpone payment for one month without any interest accumulating during that specific period.

Types of Loans

At Marcus by Goldman Sachs, you'll find various loan options to meet your needs. They offer types of loans designed to assist individuals in certain situations.

- Personal Loans: These loans can be used for combining debts, making home improvements, or making significant purchases. The loan amounts usually vary from $3,500 to $40,000, and the repayment periods can range from 36 to 72 months.

- Home Improvement Loans: Marcus classifies these loans differently because they serve a purpose even though they fall under personal loans. They are specifically designed to fund home renovations or repairs.

- Debt Consolidation Loans: These are also a type of personal loan, but they are specifically designed to help borrowers consolidate high-interest debt into a single, lower-interest loan.

Benefits of Marcus Personal Loans

Fees Free

One of the things about Marcus Personal Loans is that they don't charge any fees. This is a benefit because it means you won't have to worry about any costs affecting your loan amount. Many lenders charge origination fees, which can add to the cost of borrowing. The lack of late fees is also beneficial, although making payments on time is always advisable.

Flexible Loan Terms

Borrowers can select a repayment schedule that aligns with their circumstances, with loan terms spanning from three to six years.

Making Payments to Your Creditors

If you decide to use the loan to consolidate your debts, Marcus offers the option to pay your creditors. This handy feature makes the process more efficient. It ensures that the funds are used for their intended purpose.

Rewards

Marcus offers a unique feature where, if you make twelve consecutive on-time payments, you can defer one payment with no additional interest added to your loan.

Drawbacks of Marcus Personal Loans

High Minimum Loan Amount

The loan amount of $3,500 may exceed the requirements of borrowers. Sometimes, it leads to unnecessary borrowing and interest payments.

No Co-signer or Secured Loan Option

Marcus doesn't permit individuals to have co-signers or provide secured loans. This could limit options for borrowers with lower credit scores who might benefit from a co-signers creditworthiness or a secured loan's lower interest rates.

No Prequalification

Unfortunately, Marcus does not provide a prequalification process involving a credit check. This means you can't see your potential rates and terms without a hard inquiry, which can temporarily lower your credit score.

Comparison with Other Lenders

Marcus stands out for its no-fee policy and flexible loan terms compared to other lenders. However, lenders like SoFi and LightStream offer higher maximum loan amounts, which could benefit borrowers needing larger loans. LightStream also provides customers with a rate beat program, assuring them of surpassing any rate a competitor provides by 0.10 percentage points.

Both Marcus and LightStream do not impose any fees for loan application processing or penalties for loan repayment. Marcus also does not charge late fees, while LightStream may charge late fees depending on the loan agreement. Both lenders generally require good to excellent credit. LightStream typically requires a higher credit score than Marcus.

Marcus Personal Loans Reviews by Customers

Customers generally have a positive reception towards Marcus Personal Loans by Goldman Sachs. They appreciate the competitive interest rates, no fees, and flexible loan terms. The straightforward online application process is also praised. Generally, Marcus' loan reviews are excellent. However, some customers mention strict eligibility requirements and lack face-to-face customer service. Marcus Personal Loans is considered a reliable option for those with good credit seeking unsecured personal loans.

Is a Marcus Personal Loan Best for You?

Marcus personal loans can be a good choice if you have a good credit history. They can benefit from the competitive interest rates they offer. These loans are particularly beneficial for people who want to combine their debts because of the direct payment feature to creditors. One of the reasons Marcus loans are attractive is because they do not impose any fees. However, it's important to note that the minimum loan amount may be a drawback for those looking for loan options.

FAQs

Is it hard to get a loan with Marcus?

Getting a loan with Marcus by Goldman Sachs can be challenging as it primarily considers factors like your credit score, income, and debt-to-income ratio. Ideally, they prefer borrowers with a good credit history. Fortunately, the positive aspect is that they offer rates without imposing any charges. This makes them quite appealing to those who meet the eligibility criteria.

Is Marcus a reputable bank?

Marcus, the banking division of Goldman Sachs, has built a reputation for providing customers with interest rates on savings accounts and offering personal loans with no associated fees. This financial institution is backed by Goldman Sachs, which excels in investment banking, securities, and investment management. When you read Marcus personal loan reviews from customers, you will often find comments about the bank's rates and easy-to-use interface.

Is my money safe in Marcus?

Marcus, by Goldman Sachs, is a known bank that offers FDIC insurance. It’s good to know that your deposits are protected, ensuring safety for up to $250,000. However, it's crucial to remember that, like any investment, risks are involved. It's always wise to take your objectives and how comfortable you are taking risks into account. Additionally, Marcus by Goldman Sachs loan reviews are very good.

How long does it take to get a Marcus personal loan?

The approval process for a Marcus personal loan can be as quick as the same day, but fund disbursement may take 1-4 business days. The specific timeframe may differ for each person depending on their situation and how complete their application is.

Conclusion

Marcus by Goldman Sachs Loans is a product that stands out from the crowd. With various appealing qualities, it becomes a good option for individuals. One of the things about it is that there are no fees involved. You have the flexibility to select loan terms that align with your preferences. Another perk is that they'll even reward you if you make your payments on time. Nevertheless, it is important to remember a few points. They don't have a prequalification process, which might be a downside for some folks. Also, the minimum loan amount is quite high, so it may not be suitable for everyone. Remember, comparing options and finding the best loan for your financial situation is crucial. Take your time, weigh the pros and cons, and decide to fit your needs.