Retiring early is a dream for many people who envision a life free from the constraints of traditional work. The idea of enjoying more time pursuing personal interests, traveling, or spending quality time with loved ones is undeniably appealing. While early retirement requires careful planning and financial discipline, it is an achievable goal for those committed to making it a reality.

How to Retire Early? Retire by 40

Following are some ways to retire by 40 and have your retirement plans accordingly:

Assess Your Financial Situation

Before embarking on the journey to early retirement, it is crucial to have a comprehensive understanding of your financial situation. Take a detailed look at your income, expenses, assets, and debts. Analyze your cash flow to identify areas where you can reduce costs and save more money. Calculate your net worth by subtracting your liabilities from your assets. This assessment will provide a clear picture of your current financial standing and serve as a starting point for planning your early retirement.

Create a Detailed Retirement Plan

Developing a robust retirement plan is vital for early retirement success. Determine the specific age at which you want to retire and calculate how much money you will need to sustain your desired lifestyle throughout your retirement years. Consider living expenses, healthcare costs, inflation, and unexpected expenses. Work with a financial advisor specializing in early retirement planning to create a personalized plan that considers your unique circumstances and goals. This plan will serve as a roadmap to guide your financial decisions and ensure you stay on track toward your early retirement goal.

Save Aggressively

Aggressive saving is a key driver of early retirement. Commit to saving a significant portion of your income, aiming for a savings rate of 50% or more. Find ways to reduce unnecessary expenses and redirect that money toward your savings. Maximize your contributions to tax-advantaged retirement accounts such as 401(k)s and IRAs. Take advantage of any employer-matching contributions to maximize your savings potential. Automate your savings by setting up automatic transfers from your paycheck to your retirement accounts. You can build a substantial nest egg supporting your early retirement lifestyle by saving aggressively.

Invest Wisely

Investing is crucial for building wealth and achieving early retirement. Educate yourself about different investment vehicles and strategies to make informed investment decisions. Diversify your investment portfolio to manage risk and increase returns. Consider low-cost index funds, individual stocks, real estate, or other investment options that align with your risk tolerance and long-term goals. Regularly review and rebalance your portfolio as needed to ensure it remains aligned with your investment objectives. By investing wisely, you can harness the power of compounding and grow your wealth over time.

Minimize Debt

Reducing and eliminating debt is essential for a smooth path to early retirement. Prioritize paying off high-interest debts such as credit cards and personal loans. Develop a debt repayment plan that focuses on tackling one debt at a time, starting with the highest interest rate. Consider refinancing loans to lower interest rates and reduce monthly payments. Avoid taking on new debt whenever possible. Minimizing debt frees up more of your income for savings and investments, accelerating your progress toward early retirement.

Cut Expenses

To accelerate your savings and reach early retirement, evaluate your expenses and identify areas where you can cut back. Adopt a frugal mindset and practice mindful spending. Analyze your discretionary expenses and prioritize what brings you true happiness and fulfillment. Look for opportunities to reduce housing costs by downsizing or exploring more affordable areas to live in. Evaluate transportation expenses by considering alternatives such as public transportation, carpooling, or cycling. Reduce dining out and entertainment expenses by preparing meals at home and finding free or low-cost activities. You can save money and increase your retirement savings by consciously cutting expenses.

Increase Your Income

While saving and cutting expenses are important, increasing your income can significantly accelerate your path to early retirement. Look for opportunities to advance in your career, negotiate higher salaries, or seek promotions. Consider acquiring new skills or additional education that can enhance your earning potential. Explore side businesses or freelancing opportunities that generate additional income. By increasing your income, you can save and invest more, bringing you closer to your early retirement goals.

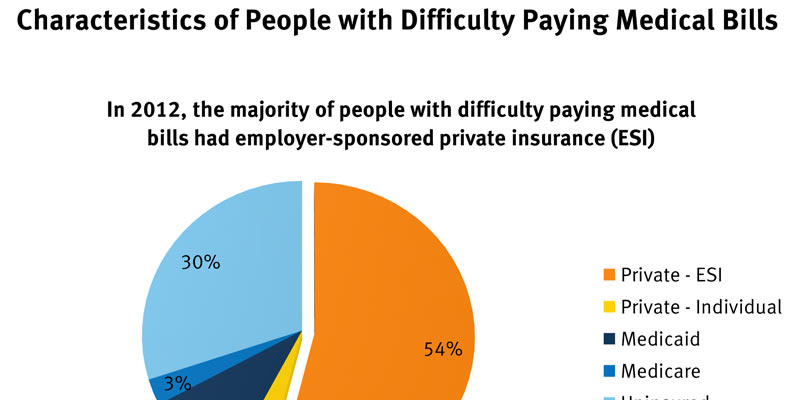

Plan for Healthcare

Healthcare costs can be a significant expense during retirement. Planning and budgeting for healthcare expenses is essential to avoid any surprises that could derail your early retirement plans. Research different healthcare options, including private insurance plans, Medicare, and Health Savings Accounts (HSAs). Understand the costs associated with premiums, deductibles, co-pays, and prescription medications. Consider the potential impact of healthcare inflation on your retirement savings. By factoring in healthcare expenses, you can ensure your retirement plan is comprehensive and sustainable.

Create Multiple Income Streams

Creating multiple income streams can provide financial security and flexibility in early retirement. Explore opportunities for passive income, such as rental properties, investment dividends, or online businesses. Diversifying your income sources can help weather economic downturns and ensure a steady cash flow during retirement.

Seek Professional Guidance

Consider working with a financial advisor who specializes in early retirement planning. They can provide valuable advice, help you optimize your financial strategy, and provide ongoing support and guidance. A professional can assist with tax planning, investment management, and creating a comprehensive retirement plan tailored to your specific needs. They can help you navigate complex financial decisions and ensure you are on track to achieve your early retirement goals.

Conclusion

Retiring by 40 is an ambitious goal that requires careful planning, disciplined saving, and strategic financial decisions. By following the steps outlined in this article, you can set yourself on a path to achieving financial independence and retiring early. Remember that early retirement is a long-term commitment that requires ongoing adjustments and dedication. Stay focused on your goals, adapt to changing circumstances, and regularly review your progress. With perseverance and a clear plan, you can retire by 40 and enjoy the freedom and fulfillment of early retirement.